Corporate banking

Corporate Overdraft

Corporate Overdraft is a technology of financing the current account of the borrower to make payments in the absence of its own funds on the current account.

Corporate Overdraft is a technology of financing the current account of the borrower to make payments in the absence of its own funds on the current account.

The Bank writes off funds from the account of the borrower fully, in other words it automatically gives a loan for the amount exceeding the balance of the own funds. Repayment of an overdraft is done automatically when money is received on current account of the borrower. Typically, the overdraft has no purpose, you can use the overdraft for a quick short-term financing of your business and liquidation of cash shortages.

Pricing overdraft options are set individually for each client and depend on the financial state, status of a client (current client or new client), collateral, and the period of continuous availability of the overdraft debt.

Basic parameters of the Corporate Overdraft:

Amount: to existing clients - 20%-30% of the average turnover, to potential clients - up to 10% of the turnover

Loan term: up to 12 months

Interest rate: The size of the interest rate determined by the decision of the Credit Committee of the Bank

Continuous Debt Time: from 1 week to 6 months

Commission: starting from 1-2%** for setting limits

Potential Collateral: deposit, real estate, equipment, vehicles. Goods in turnover and property rights are considered only as an additional collateral. Market price of the pledge (excluding deposits) must exceed the loan in 1,5-2 times.

* - Depends on the tranches' terms / the collateral / the financial position of the Borrower.

** - Commission fee can be 0% in case of interest rate includes commission amount. Commission can be paid one time or to be paid partially (monthly / quarterly / proportionally, etc.).

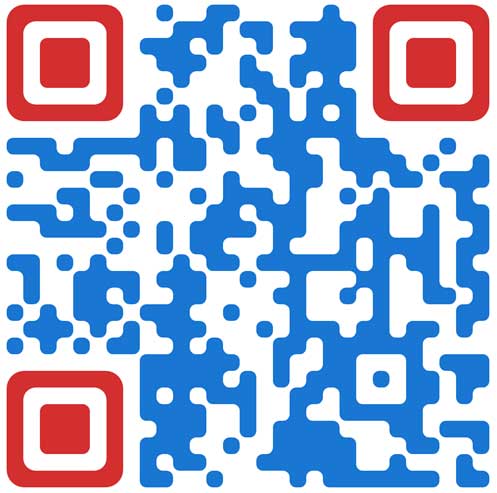

Find out more

Cash exchange rates

| Currency | Buying | Selling |

|---|---|---|

|

USD |

39.5500 | 39.7500 |

|

EUR |

42.1000 | 42.9000 |

|

TRY |

1.2500 | 1.3500 |

|

PLN |

9.7000 | 9.9000 |

|

CHF |

43.2000 | 43.7000 |

|

GBP |

48.7500 | 49.5000 |

|

HUF |

0.1010 | 0.1070 |

|

CAD |

28.2000 | 28.6000 |

|

JPY |

0.2350 | 0.2550 |

|

CNY |

5.1500 | 5.3500 |

|

AUD |

24.9000 | 25.2500 |

|

BGN |

20.6000 | 21.1000 |

|

CZK |

1.6250 | 1.6650 |

|

ILS |

9.5000 | 9.7500 |

|

RON |

8.0500 | 8.3500 |

Non-cash exchange rates

| Currency | Buying | Selling |

|---|---|---|

|

USD |

39.6000 | 39.8000 |

|

EUR |

42.1500 | 42.4500 |

Cross currency rates

| Currency | Buying | Selling |

|---|---|---|

|

|

1.0640 | 1.0740 |

|

|

3.9500 | 4.1000 |

|

|

0.9000 | 0.9150 |